Learn about Bull Flag Candlestick Pattern EN

Contents:

The breakout was tested several times before it happened. In this case, the trading range narrowed in an ascending triangle. There are two main reasons for consolidation after a big upward move in price.

It’s critical to understand that just because flags are continuation patterns, that doesn’t mean you should enter a trade immediately after you identify one. If the asset continues to move in the direction of the consolidation, it’s unlikely that the chart will form a bear flag pattern, as the trend of the flag pole has continued to reverse. If the asset instead moves in the direction of the flag pole, then a bear flag pattern has been identified. If the asset continues to move in the direction of the consolidation, it’s unlikely that the chart will form a bull flag pattern, as the trend of the flag pole has continued to reverse. If the asset instead moves in the direction of the flag pole, then a bull flag pattern has been identified. Avalanche has been in a 10 day range potentially filling out a bull flag formation.

Most flag patterns slope in the opposite direction from the previous trend, but some can be horizontal and resemble a rectangle pattern. Bull flags, like most continuation shapes, represent a bit more than a shorter lull in a bigger move. Hence, they usually form in the middle of the final move. Moreover, they occur as assets/stocks hardly move higher in a straight line for a long period because these moves are broken up by shorter periods. Here is a simple bull flag formation with FTM looking to potentially break in the coming weeks. I use the rewards on big pumps to buy ecosystem tokens such as Equal, GRAIN, Beets etc.

Silver Rally Pauses: Time to Take a Breath? – FX Empire

Silver Rally Pauses: Time to Take a Breath?.

Posted: Mon, 17 Apr 2023 20:20:00 GMT [source]

Here are a few more examples of intraday bull flag patterns that work. Notice how each one appears clean and orderly no matter the time frame of the chart. A bear flag should resume the downtrend in a stock’s price markdown. In other words, the rally in a bear flag should be higher highs and lows with lower volume — a weak rally. In this article, we’re going to dive into the fine details of the bull flag patterns.

What is a high-tight bull flag?

A bull flag also indicates that demand is stronger than supply. The „flag pole,“ or initial uptrend, should be strong in demand. Once early bears realize the strength in the overall move, they give up their early shorting efforts. The aim of this article was to study in detail the flag patterns, their main advantages and disadvantages.

Bullish candle formations are traditionally white or unfilled. Bullish candle formations signify the closing price was higher than the opening price. This is why I suggest you wait until the new breakout is clear.

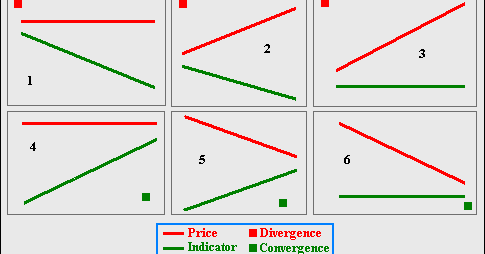

What is the difference between a bull flag and a bear flag? The bear flag is a countertrend consolidation in a downtrend. The bull flag is a countertrend consolidation in an uptrend.

- I mostly trade bull flags, especially if they are following a previous cup and handle breakout.

- To open a position, you need the breakout to be confirmed and the price to consolidate higher.

- Bull and bear flags are popular price patterns recognised in technical analysis, which traders often use to identify trend continuations.

- This is somewhat discretionary, but you don’t want to see a weak breakout on low volume.

- Now recall, this strategy is a range breakout strategy.

Again, the https://trading-market.org/est bullish flags have corrections ending around 38.2% Fibonacci retracement level. In this blog post we look at what a bull flag pattern is, its key elements, and main strengths and weaknesses. Moreover, we share tips on how to trade a bull flag and make profits. As defined in The Encyclopedia of Chart Patterns, a loose flag does not have an incredibly high/steep flag pole, and the flag is not tight; it is loose.

Triple Bottom Pattern: Trading an 87% Success Rate

As long as you time your entry points correctly and set a mental stop loss for your trade, you have a greater chance of taking advantage of this pattern. Bull flags and bear flags are mirror images of each other on a chart. Bear flags form during a period of consolidation after a precipitous drop. Bear flags come in the same shapes as bull flags — rectangles, pennants, and flat bottom.

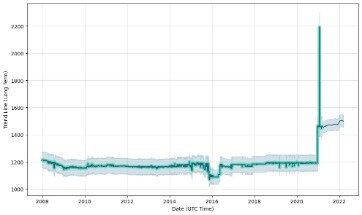

The below chart highlights an upside breakout from a bull flag pattern, which is accompanied by a high-volume bar. The high volume confirms the breakout and suggests a greater validity and sustainability to the move higher. The price breakout is preceded by large volumes, so when using the bull flag patterns, make sure to monitor their changes. Unlike a bullish flag, in a bearish flag pattern, the volume does not always decline during the consolidation. The reason for this is that bearish, downward trending price moves are usually driven by investor fear and anxiety over falling prices. The further prices fall, the greater the urgency remaining investors feel to take action.

Keep Improving Your Trading Knowledge

I became a self-made millionaire by the age of 21, trading thousands of Penny Stocks – yep you read that right, penny stocks. If you’ve been following me for any length of time, you know I love to trade based on patterns. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. Discover the range of markets and learn how they work – with IG Academy’s online course. The high volume into the move lower and low volume into the move higher, are suggestions that the overall momentum for the market being traded is negative.

Past performance is not indicative of future performance. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. See Jiko U.S. Treasuries Risk Disclosures for further details. As the pattern is retraced, the line should not move below half of the pole.

Once the bull flag pattern is confirmed, traders should consider opening a long position. Traders should pay attention to volume when trading a bull flag chart pattern. Higher volume on the upward breakout is often considered a trend confirmation. This means traders should be vigilant and wait for higher volumes before entering a trade on any breakout situation.

Strategy #1: Bull flag trend continuation strategy

The pattern is usually complete with a target projected equal to the height of the flagpole added to the breakout level. There has been a lot written about bull flags, but academic research into flag patterns suggests that only one flag is successful. Learn how to identify and use the high-tight flag in your trading. On Phemex, you can combine the bull and bear flag patterns with other indicators to help plan out your trades. The best indicators to combine with flag patterns are popular indicators such as the Relative Strength Index , which can help show if the existing trend is oversold or overbought .

The only difference is the patience it takes to allow the pattern to develop. As you can see from the image above, the context is everything when comparing a bull flag to a bear flag. That being said, they are both very similar and should be treated almost identically, just in different trending contexts.

The bull flag formation flag starts with a significant fall in prices, followed by a period when the price remains between 2 lines. It is thought that the bear flag suggests the price will continue to move downward once it leaves the area between the 2 lines. Volume may increase first and then decrease as the formation reaches the endpoint. There may be an uptick in volume during the breakout, although it may be minimal. The trend ends with the price moving in the same direction as the breakout.

Stellar Lumens (XLM) Price Prediction: When $1?

If you search for information on how to trade bull flag patterns, you’ll notice there are differing definitions about what is and isn’t a true bull flag. One trader will tell you the flag is only a ‘real flag’ if it forms between five and 20 days. The main benefit of trading bull flag patterns is that they can be more reliable.

Ethereum, Dogecoin Rise Even As Bitcoin Drops Below $30K: Why … – Investing.com UK

Ethereum, Dogecoin Rise Even As Bitcoin Drops Below $30K: Why ….

Posted: Mon, 17 Apr 2023 03:40:00 GMT [source]

It reflects the market’s strong commitment to continue moving in the same upwards direction, despite any short-term pullbacks. Traders should be aware of the previous trend and make sure it’s still intact before entering a trade. The Bullish Flag Pattern is a trend continuation chart pattern. A bull flag pattern is a chart pattern that occurs when a stock is in a sharp strong uptrend.

What does a Bear Flag Pattern look like?

The study authors found that 97% of traders with more than 300 days actively trading lost money, and only 1.1% earned more than the Brazilian minimum wage ($16 USD per day). Volume patterns may often be used in conjunction with flag patterns, with the aim of further validating these formations and their assumed outcomes. In terms of managing risk, a price move above the resistance of the flag formation may be used as the stop-loss or failure level. In terms of managing risk, a price move below the support of the flag formation may be used as the stop-loss or failure level.

If the security price breaks out above the bull flag resistance, especially with a volume increase, it signals a potential 85% chance of going higher. The American Electric Power Company chart above shows a high-tight bull flag. According to an analysis of 1,028 trades, only one bull flag pattern has a success rate of 85%, while the rest have a failure rate of 55%. The high-tight bull flag is the only flag pattern you should trade.

- A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart.

- The patterns are characterized by a clear direction of the price trend, followed by a consolidation and rangebound movement, which is then followed by a resumption of the trend.

- IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

- To learn strong entry and exit points and get involved in our trading community, apply for my Trading Challenge.

We have partnerships with companies whose products we love. Trade the breakout of the flag in the direction of the pole. After the strong move higher, the market becomes overbought so the market needs to take a “rest”. Here’s where you can expect a potential Bull Flag to form. A small break before the market continues moving in the same direction.